I read that a 'closed end' lease, where you can't buy the car at the end, is a rental agreement in the eyes of the law, but an 'open-ended' lease, where buying is an option at the end, is actually a purchase agreement, making the lessee the 'owner' from day 1 of the lease. You should be able to file the tax credit form, but only include what you've paid that year as a credit. The credit, like solar credits, can be rolled over into future years, I think there is also a limit of two vehicles per person, so you'd get "up to" 30% or $7500 which ever is less, for each car, and you'd deduct credits from taxable income as you pay.

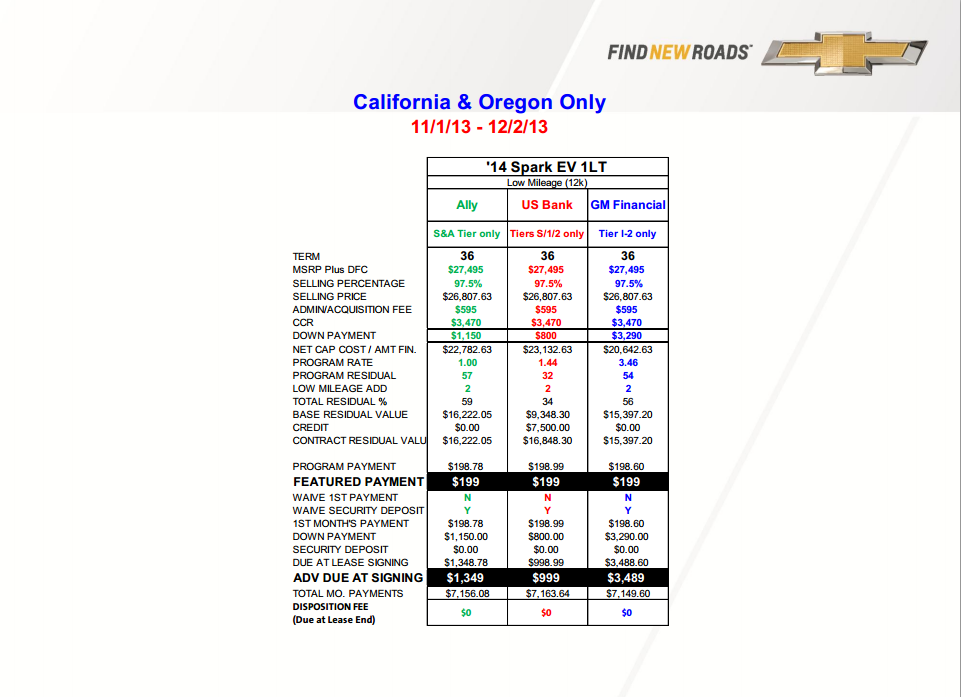

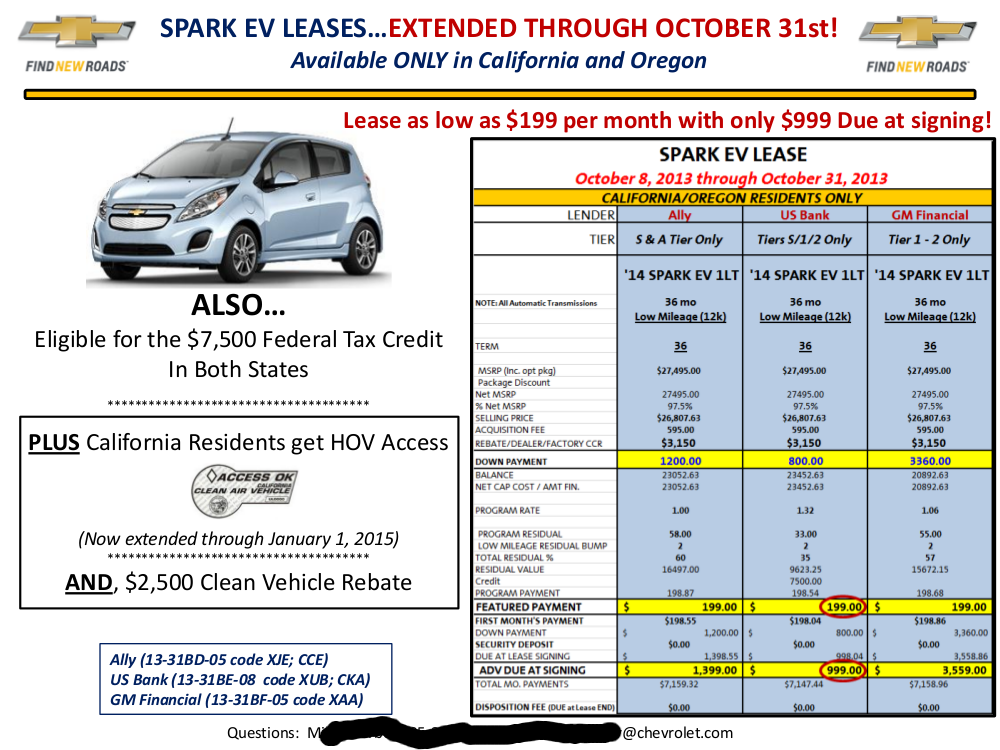

So the US Bank lease would allow that? And the other two lease plans would not, because they (the leasing companies) have already claimed the tax credit? How can that be? There can only be one owner?

These are the kinds of questions (and many more technical questions) that I asked and no one knew about. I asked "where does the $7500 tax credit go when you lease?", and Diamond Hills Chev said, " Take the US Bank offer and you'll get the $7500 if you buy the car at lease end". Then they substituted another lease without that option two hours before I showed up for the car, saying the US Bank lease terms were no longer available. That was one of the lies. Beautiful car, neanderthal dealer. During that two month or so period, I tried to access various Chevrolet and GM customer service/support/questions chat rooms and telephone numbers. I got really wrong information continually. 1-855-477-2754 is a number given to me by a GM support service one Saturday. The fellow said to me," We don't have any technical information, nor can we send or receive email, but you can call this number Monday morning, 9 to 5 EST, it's a special number just for Spark EV owners with technical questions". Perturbed that I had to wait 36 hours, I called first thing Monday and was told that the Spark EV would only charge on 110V level I chargers, period. Wow.

![4 Ports Fast Car Charger,[Upgrade Voltmeter Display] PD+QC3.0 Car Charger Adapter for 12-24V Cigarette Lighter Plug,Car Phone Charger Compatible with iPhone/Android/Samsung/iPad(QC3.0+PD+2.4A+2.4A)](https://m.media-amazon.com/images/I/41fxaOeWS4L._SL500_.jpg)